The COVID-19 outbreak has shaken and stirred the already volatile bunker market. While the refiners adjust their capacities and shipping lines choose their path to compliance, the market dynamics are yet to reach an equilibrium

Few months back towards the end of the year 2019, the maritime industry was abuzz planning to comply with the IMO 2020 emission norms. Shipping lines were busy choosing among scrubbers and different fuel blends, shippers had kept their fingers crossed to calculate the additional fuel surcharge cost that they would have to shell out and the bunker suppliers were busy gearing up their production operations to meet the sudden surge in demand for low sulphur fuel. The shipping industry consumes about 4 million barrels per day (bpd) of marine bunker fuels and the rule changes impacted more than 50,000 merchant ships globally, opening a significant new market for fuel producers. India’s marine fuel demand is estimated at about 1.7 million tonnes per year, largely supplied by State-owned companies. Out of this, some 0.965 mmtpa is high sulphur furnace oil, while the rest is distillate fuel. At the start of 2019, low-sulphur fuel sales accounted for just 8 per cent of total sales compared with a jump to 70 per cent in December.

“Majorly all global bunkering ports are keeping the maritime industry fuelled with IMO 2020 compliant low sulphur fuel oil (LSFO). Out of 34 major bunkering hub ports, only Sydney in Australia is not yet servicing the request of LSFO,” opines Capt. Vivek S. Anand, Director, NYK Line (India) Pvt. Ltd. “Usually the preferable bunkering port is where there is minimum diversion in trading route with competitive prices. However, preferred bunkering port is Singapore because of its strategic location and price of $290 or Fujairah with a price ranging around $280. India is well equipped to supply IMO 2020 compliant low sulphur fuel oil (LSFO) with 0.5 per cent sulphur as marine fuel at all Indian major trading Ports.”

Owing to the uncertainty over the level of preparedness of the industry in dealing with the change, Captain SIAK Azad, Deputy Nautical Advisor at the Mercantile Marine Department, said that the regulator’s priority in the first few months will be ease of doing business. “Trust and common sense will be applied and we won’t go just by the letter of the law,” he informed.

Asian refiners have the upper hand

Asia is set to benefit from IMO 2020 more than any other region due to its surplus of gasoil and relatively high complexity of its refineries, reports S&P Global Platts. Asian refiners have continuously upgraded operations, achieving greater yields of low sulphur products, thus they are on a better footing to adjust for IMO 2020. China and India are well-placed to take advantage of the bunker specifications change with their high ratios of coking and hydrocracking versus crude distillation capacities. Japan is a major LSFO producing and consuming country in Asia while South Korea is a major gasoil exporting country. Both stand to benefit from high distillate cracks. Singapore, as the world’s largest bunkering hub, will have to make major changes as it is a major importer of HSFO. Singapore’s product demand composition will undergo a drastic change, with HSFO demand dropping in 2020 while demand for MGO and LSFO rises.

In 2020, Singapore will still be a net importer of HSFO, supplying to vessels installed with scrubbers, but most of its demand will switch to 0.5% LSFO and MGO, creating new challenges to its supply chains. Overall, the changes are likely to benefit refining in Asia, which is long on gasoil, and the major bunker suppliers and China are developing supply options for LSFO.

India’s conversion ratio – or the amount of more complex conversion capacity, such as fluid catalytic cracker (FCC), resid catalytic cracker (RCC), hydrocrackers (HCU), or coking capacity relative to CDU capacity – has improved the most among Asian refiners. It is expected to reach a new high after a series of upgrading works to prepare refineries for a nationwide rollout of the Bharat VI standard, which applies to gasoline and gasoil and mandates a limit of 10 ppm sulphur, equivalent to Euro 6, in April 2020.

However, China’s conversion ratio is still ahead, although the improvement has slowed over the last few years. China implemented the Nation 6 standard with 10 ppm sulfur levels (equivalent to Euro 6) nationwide in January 2019. Japan’s refinery conversion ratio has improved due to CDU closures as part of the METI’s Refinery Ordinance. Japan is well ahead in its preparations as it has substantial residue desulfurization facilities, which were originally built mostly to make LSFO for power generation. South Korea’s conversion ratio also improved over the years due to upgrading.

A look at top global suppliers

China

Sinopec Corp. is producing very low-sulfur fuel oil (VLSFO) at 10 refineries in China, including Zhenhai Refining and Chemicals Co, Jinling Petrochemical Co and Hainan Petrochemical Co. The company aims to reach the 10 million tonnes VLSFO capacity per year by 2020, further increasing it to 15 million tonnes by 2023. It will supply to Zhoushan and other major ports in China, while covering Singapore, Hambantota and 50 key overseas ports around the globe.

PetroChina aims to a 4 million tonnes of VLSFO in 2020, to be produced from its Jinzhou, Jinxi and Dalian refineries in China’s northeast, and Guangxi refinery in the south. China Marine Bunker secured minimum 4 million tonnes of VLSFO for the fourth quarter of 2019 and the first two quarters of 2020, while it also began supplying all major Chinese ports from bonded storage.

North Asia

SK Energy, the first of South Korea’s refiner, started supplying MGO from October last year, aiming to produce up to 27,000 bpd of marine gasoil. Additionally, the company is constructing a vacuum residue desulphurisation (VRDS) unit that can produce 40,000 bpd of LSFO, which will come into force in March or April 2020. SK Trading International, its affiliate, inked six-month contracts with some shippers in order to supply 90,000 barrels of VLSFO, beginning from Q4. Hyundai Oilbank is producing up to 50,000 barrels of LSFO per day.

In Japan, Fuji Oil Co Ltd, Cosmo Energy Holdings Co Ltd and Idemitsu Kosan Co Ltd began shipping IMO-compliant fuels in October last year. Idemitsu Kosan is planning to increase capacity at its 190,000-barrel-a-day Chiba refinery’s residue crude hydro-desulphurizing unit, to boost output of LSFO or other IMO-compliant fuels.

Singapore/Southeast Asia

About 400,000-500,000 metric tonnes/month of low-sulphur fuel oil cargoes have been coming to the Singapore region in the fourth quarter of 2019, while the volume was 100,000-200,000 metric tonnes/month earlier. Singapore, the world’s largest bunkering hub, used to receive 6 million mt/month of high-sulphur fuel oil until the first half of 2019. Towards the end of 2019, Royal Dutch Shell loaded its first VLSFO cargo from its Pulau Bukom refinery. Singapore Refining Company (SRC), a joint venture of Chevron Corp and Singapore Petroleum Co supplied its first VLSFO cargo.

Chevron is about to double its VLSFO and MGO supply in Asia in the next one to two years. Vitol is building a 30,000 bpd crude processing unit, located in Malaysia, which will begin supplying VLSFO in May 2020. IRPC Pcl is producing 60,000 tonnes of VLSFO, making it Thailand’s first refinery to produce IMO-compliant fuel. About 65 per cent of the output will be sold in Thailand while the rest will be exported.

India

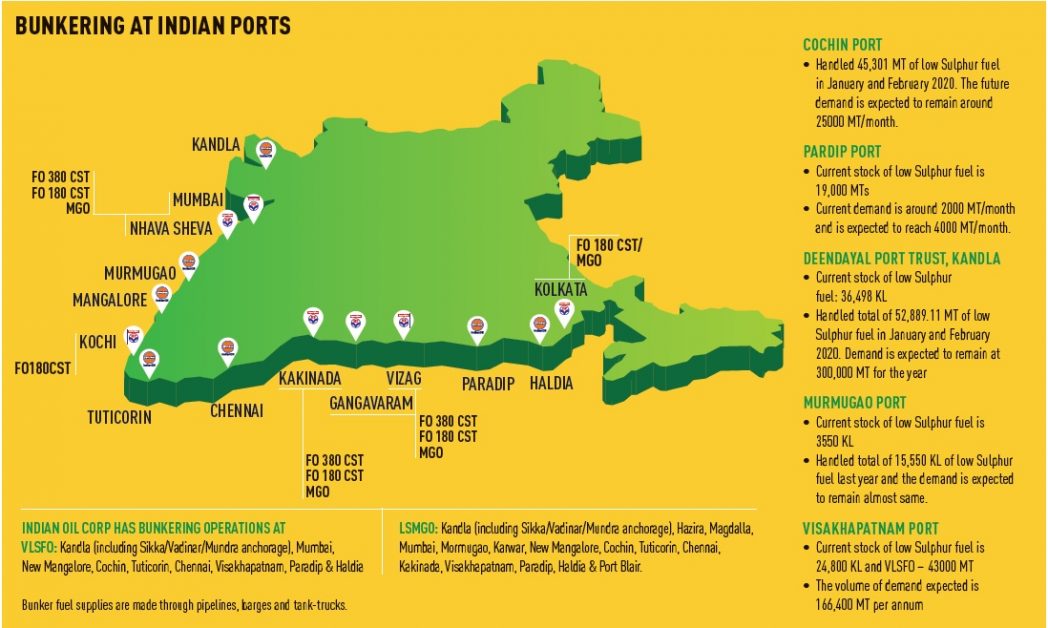

Indian Oil Corporation released its first deliveries of 0.5 per cent LSFO bunker in November at Kandla, Cochin and Paradeep ports. The compliant fuel is also being made available at Mumbai, Mangalore, Tuticorin, Chennai, Visakhapatnam, Paradip and Haldia Ports. According to Platts, IOC aimed to supply more than 1 million mt/year of cleaner fuel from its Haldia refinery on the eastern coast and the Gujarat refinery on the western coast. IOC has a market share of 60 per cent in ship bunker in India. Further, IOC’s product is a straight-run residual and not a blend with any distillate, and, therefore, friendly to shipboard engines and fuel-handling equipment. Regarding other properties like viscosity, density and pour point, the new compliant fuel would be similar to the old fuel and is compatible with tried-and-tested ship machinery.

The first batch of Hindustan Petroleum Corporation Limited (HPCL’s) VLSFO was produced in December at Visakhapatnam Refinery that can produce 5,000-10,000 tonnes per month to begin with. Infrastructure will be upgraded soon to cater to the demand. The oil major operates another refinery on the west coast in Mumbai. The product meets the Residual Marine Grade (RMG) 0.50 Specification and ISO 8217:2017 standard requirements. HPCL’s new compliant fuel product is also a straight-run residual.

In February Bharat Petroleum exported its first low sulphur fuel cargo from Kochi Port to Singapore. P Murali Madhavan, Executive Director (Kochi Refinery), BPCL said they are also supplying the compliant fuel to tankers calling at Kochi Port.

Middle East

Qatar Petroleum is supplying VLSFO at its ports since October last year. Uniper Energy DMCC is responsible for two crude units in Fujairah, which produce on an annual basis more than 4 million tonnes of VLSFO. Brooge Petroleum and Gas Investment Co (BPGIC) is developing a 25,000-bpd capacity low-sulphur fuel refinery in Fujairah.

Europe

Peninsula Petroleum, the biggest supplier in the fuelling hub of Gibraltar, is doubling its VLSFO deliveries to 60,000 tonnes. It supplies bunker to the ports of Gibraltar, Algeciras, Barcelona, Amsterdam-Rotterdam-Antwerp, Canary Islands, Malta, Panama, U.S. Gulf Coast and Los Angeles.

United States

The majority of US Gulf Coast refiners are already processing heavy crudes to make IMO-compliant marine fuels. Motive Enterprises updated its Port Arthur, Texas, refinery to produce compliant fuels. PBF Energy restarted a coker at its Chalmette, Louisiana, refinery that had been idled nine years.

Changing market dynamics

The International Energy Agency (IEA) has forecast VLSFO demand to reach 1 million bpd in 2020 and 1.8 million bpd by 2024, while marine gasoil demand will peak in 2020 and reduce to 1.8 million bpd by 2024. Contrary to the speculations on initial shortage of the compliant fuel supply, IEA has confirmed that the preferred compliant marine fuel supplies at key hubs is adequate. An expected surge in China’s VLSFO production as a result of its new tax policies has also helped ease concerns about tight supplies.

As the IMO 2020 compliance deadline came close, ship operators rushed to buy large quantities of compliant fuels to ensure adequate supplies, piling pressure on bunker suppliers and pushing premiums for delivered fuels to record highs. The strong demand for VLSFO led to a sharp increase in its price which sharply narrowed its spread with the more expensive marine gasoil. Thus, refiners around the world responded by boosting VLSFO production. Preliminary estimates from The Maritime and Port Authority of Singapore and BIMCO indicated that sales of low-sulphur fuel oil and low-sulphur marine gasoil in the bunkering hub, rose by 51 per cent month-on-month in December 2019 to 3.13 million tonnes, compared with the 1.27 million tonnes of high-sulphur fuel oil sold in the same month. At the start of 2019, low-sulphur fuel sales accounted for just 8 per cent of total sales compared with a jump to 70 per cent in December. “Price for LSFO ranges from $230 in Rotterdam/Antwerp, Kaliningrad, Murmansk/Archangelsk to $590 in Ecuador. Going forward, we do see a downward trend in prices with increase in Production of LSFO at major refineries and competitiveness among major players battling to grab a bigger share of the market,” informs Capt. Vivek Anand.

Adding to this surge in VLSFO demand are the delayed scrubber installations, which mean that ships expected to run on high-sulphur fuels also had to jostle to secure VLSFO supplies and meet the IMO rules. There is currently a four-to five-month backlog of vessels that should have been retrofitted by the end of last year. Installations have been delayed chiefly by material shortages and limited shipyard capacity further complicated by the shortage of personnel at Chinese yards due to the recent pandemic outbreak.

Prices of 1 per cent sulphur fuel oil also gained ground this year, as the shipping industry uses it for blending to produce 0.5 per cent sulphur fuel oil. Many bunker suppliers have even stocked it for using in the marine fuel pool in 2020. Previously 1 per cent sulphur fuel oil was mainly used for power generation.

But in the subsequent months Asia’s market for VLSFO retreated from its record highs witnessed near the start of the year, as demand for the compliant fuel crumbled under seasonal factors and due to the Corona epidemic. However, industry observers also point at a trend of more ships switching to burning marine gasoil instead of VLSFO which weakened the VLSFO market.

“The market environment for marine fuels has been very volatile over the past months. While our IMO 2020 fuel sourcing strategy focuses on compliant fuels for the vast majority of our fleet, we have decided to invest in a number of scrubbers to mitigate risk and familiarise with the technology in case it turns out to provide significant cost benefits compared to compliant fuels. Thus, scrubbers form a secondary part of our overall IMO 2020 fuel sourcing strategy to ensure compliance and spread the risk of fuel price uncertainty in 2020 – for the price spread between high and low sulfur fuels and for the price of future 0,5% compliant low sulfur fuels,” reveals Steve Felder, Managing Director – Maersk South Asia.

Bunker traders are of the view that the IMO 2020-led marine gasoil demand has started to finally kick-in but the virus situation is restraining demand. The market is stabilising and people are hoarding less and buying bunkers as and when needed.

Refiners to trim low sulphur fuel production

A major disruption to marine transportation due to the corona virus outbreak has cooled down the rally in prices of low sulphur fuel, making refiners particularly in Asia to scale back production of the compliant fuel. Refiners particularly those in Thailand and Taiwan are now grappling with narrowing margins amid the slump in demand for low sulphur fuel.

Early bets by refiners to produce LSFO at the cost of other products paid off handsomely as benchmark 0.5 per cent marine fuel prices in Singapore surged to a premium of more than $327/mt to 380 CST high sulphur fuel oil on December 26. But crack spreads for LSFO that trumped both gasoil and gasoline for much of the past two months have corrected sharply in recent sessions, and signs are beginning to emerge that refineries are adjusting output in response. It is reported that refiners in India, Japan and South Korea that also tweaked refinery operations to sell an occasional LSFO cargo were likely to follow suit as MF0.5% cracks come under pressure.

In Thailand, where much of the switch to produce LSFO came via a move from high-sulphur crudes to low-sulphur ones, traders say refiners may take longer to scale back production. The country currently exports around 150,000-200,000 mt/month of low-sulphur fuels, one of the highest outflows in the region.

Scrubbers remain a viable option

Shipping companies are pushing ahead with multi-million dollar investments to install scrubbers, despite concerns that a narrowing spread between high and low sulphur fuel prices could delay the return on those investments. The strategy has paid off well initially as prices of high sulphur fuels declined as compared to low sulphur fuel. As reported by S&P Global Platts towards the 2019 year end, Singapore 380CST HSFO was at a discount of $327.47/mt compared to Singapore marine fuel 0.5 per cent, but by March 2020 the scenario changed and the spread between the two fuels had crunched to a five-month low of $108.84/mt, thanks in part to tighter supply of high sulphur fuels and soft LSFO fundamentals. The decline in cost of HSFO has been slow as compared to LSFO.

According to fuel price reporting agency Argus Media, the price of 0.5 per cent VLSFO in Singapore is now 37 per cent below what it cost on January 1, reaching $393.25 per tonne on March 2. That compares with 3.5 per cent fuel oil at $314 per tonne, down 6 per cent over the same period. The slow decline in the price of HSFO can increase the payback time for fitting scrubbers. Still some shipowners are opting for scrubbers as a strategy to hedge bunker fuel risks, even though installations at some Chinese shipyards are getting delayed due to the Corona Virus outbreak.

The pandemic has further slowed down the trade and has brought down freight rates so much so giving another reason for shipping lines to opt for scrubbers. The losses in terms of revenue when a ship is sitting in a dockyard for retrofitting scrubber have decreased a lot this year as compared to last year. Last year a shipping line would have lost $20,000/day if a ship was launched for 40 days to fit a scrubber, the same loss has now come down to around $2,000/day with the fall in freight rates. Further, over the months the installation costs for scrubbers have also said to come down.

As far as tankers are concerned, some scrubber-fitted ships are still commanding a premium over non-scrubber ones, making a positive case for installing the technology. It is reported that for modern VLCCs, the premium is currently around $7,000/day. A scrubber-fitted and non-scrubber VLCC is currently being offered around $44,500/day and $38,000/day. The corresponding numbers for a one-year time charter are closer to $43,000/day and $36,000/day. Ships that retrofitted scrubbers before the compliance deadline will continue to reap greater benefits as the price of HSFO continues to fall.