The demand for 3PL services stems from interlinked stakeholders across the supply chain, including wholesalers, retailers, and e-commerce players. These stakeholders have adopted a combination of ‘just in time’ and ‘just in case’ strategies to optimize their inventory storage and delivery capabilities and mitigate long lead times.

Consequently, occupiers with inefficient infrastructure are increasingly turning to 3PL providers to meet their storage and delivery requirements. By utilizing shared space with 3PL providers, occupiers can benefit from cost advantages through the consolidation of transport, distribution, and shared warehouse expenses. This cost-effective approach has led to a strong and continuous demand for 3PL services, which is expected to persist in the foreseeable future.

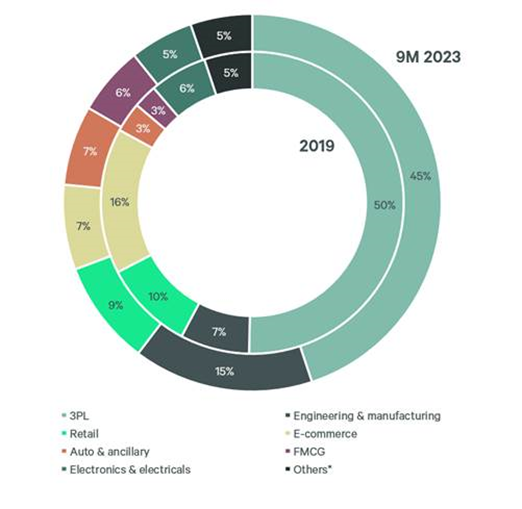

Moreover, in the past two years, there has been a notable surge in demand from engineering and manufacturing (E&M) players, largely attributed to government initiatives such as the Production Linked Incentive (PLI) scheme. These policy enablers have encouraged growth in the manufacturing sector, leading to increased demand for warehousing facilities within the E&M segments. The implementation of the PLI scheme has had a cascading effect, extending its impact to the auto and ancillary sector as well. As a result, the share of I&L absorption from the auto and ancillary sectors has risen from 3% in 2019 to 7% in Jan-Sep’23.

The I&L absorption would continue to be led by the 3PL and E&M sectors due to the continued adoption of ‘multipolar’ supply chain strategies by occupiers and the government’s pro-investment efforts. Consumer demand for FMCG, retail, electronics, and electrical products has intensified over the last few years. This heightened consumer demand has led these industries to reassess their warehousing and logistics strategies to meet evolving customer expectations. As a result, there is a growing need for efficient and streamlined warehousing and logistics solutions, which in turn has significantly contributed to the overall demand for warehousing within these sectors. The Industrial & Logistics sector is likely to touch a 5-year high absorption mark and touch 36 – 38 mn. sq. ft. in 2023 across top 8 cities in India. Supply addition, too, is expected to outperform, touching 35 – 37 mn. sq. ft. by the year-end, driven by the completion of pent-up projects.

2024 – Industrial & Logistics (I&L) Backed by strong demand, leasing momentum is expected to further strengthen in 2024. Rising transportation costs are likely to drive 3PL, engineering & manufacturing, retail, and e-commerce players to lease more space near industrial hubs, consumer hubs and key transportation nodes. Occupiers would increase focus on upgradation/expansion opportunities in tier-I cities, new market penetration in lower tier cities, and extension of local distribution networks in emerging logistics hubs. Demand for quality supply will persist amid growing flight-to-quality sentiments among occupiers. The completion of new logistics and industrial projects by foreign-funded investment platforms will continue to bolster investors’ confidence and interest in the Indian market.