The gain in land prices in the Colombo district accelerated during the first half of the year, bucking a decelerating trend that lasted for two years, in a reflection that land prices are being gradually bid up with the rising demand caused by re-invigorated economic activities with lower interest rates also acting as a strong pull factor.

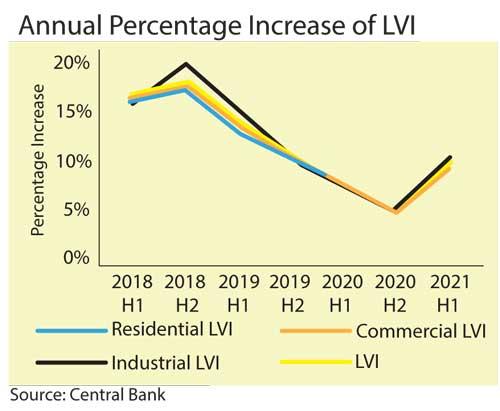

The Land Value Indicator (LVI), a key gauge of land prices in the Colombo district rose to 155.1 in the first half of 2021 from 141.6 in the first half of 2020, logging a 9.5 percent increase, accelerating from 4.6 percent gain recorded through 2H’20, which demonstrated the bottomed out level.

The Land Value Indicator (LVI), a key gauge of land prices in the Colombo district rose to 155.1 in the first half of 2021 from 141.6 in the first half of 2020, logging a 9.5 percent increase, accelerating from 4.6 percent gain recorded through 2H’20, which demonstrated the bottomed out level.

The gains in Colombo land price started decelerating from near 20 percent levels reached during 2H’18, the behaviour of LVI illustrated by Central Bank’s Statistics Department showed.

Meanwhile, the LVI measured based on a semi-annual basis also demonstrates an increase of 6.8 percent in land prices during 1H’21, accelerating from 2.5 percent in 2H’20.

The LVI for 1H’21 shows gains in land prices across all three land types, categorised by their use – residential, commercial and industrial -with the most increases seen in industrial use lands.

For instance industrial land prices rose by 10.1 percent in the year to 1H’21, accelerating from 4.6 percent in 2H’21 while their prices rose by 7.4 percent on a semi-annual basis, accelerating from 2.5 percent in a sign that there is growing appetite for industrial activity in and around the Colombo district which has close linkages to the port, air port and city centre to set up manufacturing bases.

Meanwhile the residential land prices rose by 9.6 percent from a year ago and 6.8 percent from the 2H’20.

The commercial lands followed an 8.8 percent increase in their prices during the twelve months to June 2021 while such prices rose by 6.1 percent from the levels seen in 2H of 2020.

The residential land price acceleration also coincides with the government reducing the home loan rates to 7.0 percent, fixed for 5 years which came into effect from December 2020 aimed at increasing home ownership.

The behaviour in land prices since 1H20 is also an indication that the broader property and real estate sector in the country have been vibrant and the pandemic hasn’t been able to send a dent on the sector.

Nevertheless the virus may have had some impact on commercial land values which ended up third based on land price increases during 1H21, due to delayed plans to expand office space and retail space by some commercial tenants, caused by the virus induced disruptions to their way of working and businesses.

Source : Daily Mirror