Agri-exports touched $41.8 billion in FY 2020-21, registering a growth of 18 per cent over the previous year. This has brought some cheer within government circles and helped improve domestic farm prices somewhat. However, even these exports fall much short of the target of $60 billion that the Narendra Modi government set out to achieve by 2022. From a strategic point of view, therefore, one must ask whether this growth rate can be sustained over a longer period, and the implications it has for Indian agriculture. To answer this question, one needs to look at the composition of agri-exports.

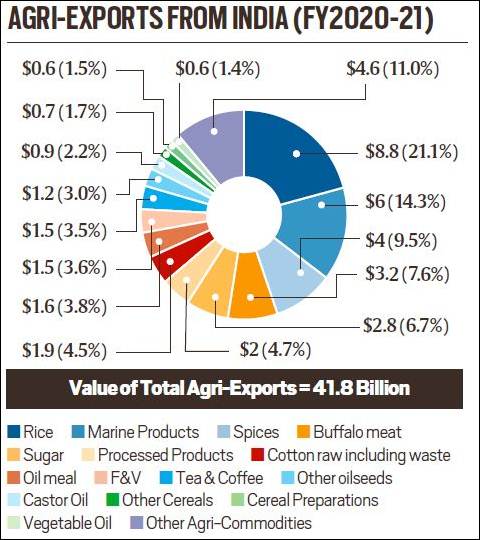

Amongst the various agri-commodity exports, rice ranks first with 17.7 million tonnes valued at $8.8 billion, roughly 21 per cent of the total value of agri-exports. It is followed by marine products ($6 billion), spices ($4 billion), bovine (buffalo) meat ($3.2 billion) and sugar ($2.8 billion (see Figure 1). Environmental sustainability concerns about rice and sugar, however, warrant a re-examination of the country’s export basket.

Rice and sugar are well-known water guzzlers. They are heavily subsidised through cheap/free power for irrigation as well as fertilisers, especially urea. Moreover, the export subsidy given by the government to clear excessive domestic stocks of sugar has led many other sugar-exporting countries like Australia, Brazil and Thailand to register a case against India at the WTO, which India may find difficult to defend. In the case of common rice, our earlier research shows that power and fertiliser subsidies account for about 15 per cent of its value in states like Punjab and Haryana. If these subsidies are withdrawn or rationalised through direct income transfers to farmers, rice will not be as preferred a crop with farmers as it is today.

The biggest concern with surging rice and sugar exports from India is on the sustainability front. Policymakers need to give serious thought to such concerns while chalking out a sustainable strategy for agri-exports. India is a water-stressed country with per capita water availability of 1,544 cubic metres in 2011, down from 5,178 cubic metres in 1951. This is likely to go down further to 1,140 cubic metres by 2050. It is well known that a kg of sugar has a virtual water intake of about 2,000 litres. In 2020-21, India exported 7.5 million tonnes of sugar, implying that at least 15 billion cubic metres of water was exported through sugar alone. Another water guzzler, rice, needs around 3,000 to 5,000 litres of water for irrigating a kg, depending upon topography. Taking an average of about 4,000 litres of water per kg of rice, and assuming that half of this gets recycled back to groundwater, exporting 17.7 million tonnes of rice means that India has virtually exported 35.4 billion cubic metres of water just through rice. Also, rice cultivation contributes to more than 18 per cent of the GHG emission generated from agriculture.

If we must continue with rice exports of this magnitude, the crop has to be farmed in a water-efficient manner and with a lower GHG (methane) footprint. Farming practices such as alternate wetting drying (AWD), direct-seeded rice (DSR) and micro-irrigation will have to be taken up on a war footing. Farmers may be incentivised and rewarded to save water, switch from paddy and sugar to other less water guzzler crops, and reduce the carbon footprint.

At a broader level of agri-trade, it may be noted that during the seven years of the Modi government, agri-exports have remained lower than the level reached in FY2013-14 ($43.3 billion (see Figure 2). That was when the highest agri-trade surplus (exports minus imports) was generated ($27.8 billion). That was also when Indian agriculture was most globally integrated, with agri-trade (exports plus imports) touching 20 per cent of the agri-GDP. It has slid to 13.5 per cent by FY2020-21, indicating India is becoming less globally competitive in exports and more protectionist in imports, presumably in the name of Atmanirbhar Bharat. It is high time to review current agri-trade policies and accompanying tariff structures. A longer-term strategy must also aim at conserving scarce resources of water and energy, and reducing the carbon footprint.

Closer evaluation of non-basmati exports exposes another interesting fact: These exports are actually sourced not only below-MSP but also below the average domestic mandi prices prevailing in the country after one adjusts for freight from mandi to port and loading charges at the port. How does that happen? One possibility is that a substantial part of supplies through the PDS and the PM Garib Kalyan Yojana are leaking out and swelling rice exports.

It is high time that policymakers revisit the entire gamut of rice and sugar systems from their MSP/FRP to their production in an environmentally sustainable manner. We must ensure that we produce more from every drop of water. Also, at least in the case of rice, procurement will have to be limited to the needs of PDS, and within PDS, it is high time to introduce the option of direct cash transfers. All these will go a long way to promote better diversification of our agri-systems and better use of our scarce water supplies and lesser GHG emissions. We could save on the unproductive use of financial resources locked up in burgeoning grains stocks with the FCI. These savings can be used for doubling investments in agri R&D to improve productivity on a sustainable basis and improve farming practices for minimising carbon emissions. An export-led strategy also needs to minimise logistics costs by investing in better infrastructure and logistics. Only then one can ensure sharing the returns of these investments with farmers to give them a better deal in terms of higher and more stable incomes.

Source : Indian Express