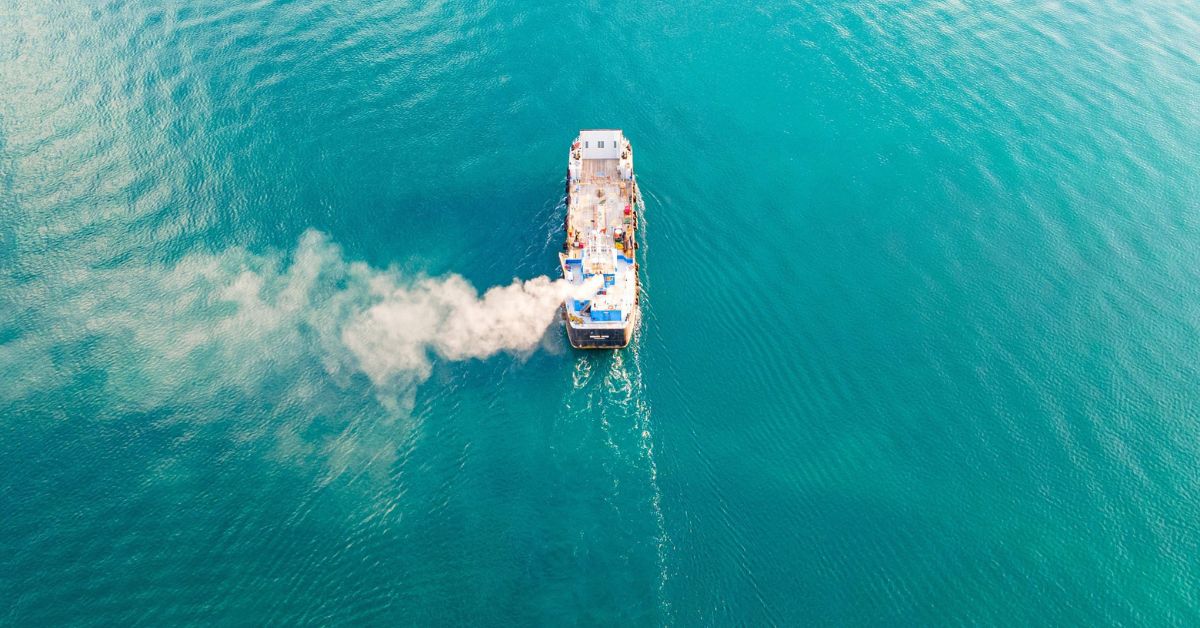

Carbon pricing is rapidly moving from regulatory theory to financial reality for the global shipping industry, reshaping balance sheets and business models across the maritime ecosystem.

In 2025 alone, the inclusion of shipping in the EU Emissions Trading System (ETS) is expected to add more than $6 billion in compliance costs, according to estimates by emissions analytics firm Siglar Carbon. By the end of this decade, as additional regional and global carbon pricing schemes take hold, that figure could surge past $50 billion annually.

The projected total reflects the combined impact of overlapping measures such as the EU ETS, FuelEU Maritime, UK ETS, and the IMO’s upcoming Greenhouse Gas Fuel Intensity (GFI) regulation, due to start in 2028. Siglar warns that if these frameworks operate simultaneously — and more nations follow Europe’s lead with local emission levies — the global carbon cost for shipping could approach $100 billion a year by 2030.

Analysts at LSEG Research expect European carbon prices to reach $150 per tonne of CO₂ by 2030, significantly raising the cost base for operators reliant on fossil fuels.

The IMO’s GFI scheme will overlay a worldwide carbon compliance mechanism on all international voyages. Early projections suggest it could impose $22 billion in annual costs at launch, increasing to $33 billion by 2030.

A major uncertainty remains: will the IMO’s framework supersede existing regional regimes or add yet another layer of costs? A fragmented system could create uneven competitive pressures, with certain routes and operators facing steeper penalties.

For shipowners, operators, and financiers alike, carbon pricing has evolved from an environmental obligation into a core financial determinant. It now shapes time charter returns, voyage economics, credit assessments, and insurance risk models, firmly embedding emissions into the industry’s commercial equation.