[vc_row][vc_column][vc_column_text]

The Dedicated Freight Corridors (DFCs) will transform Indian Railways and have a multiplier effect on the GDP, says Bharat Salhotra, Managing Director Transport – India and South Asia for Alstom. Explaining the importance of connecting the Golden quadrilateral with dedicated freight corridors, Salhotra elaborates that with decongestion of lines, the average speed of trains will pick up in the coming years. In an exclusive interaction with FE Online, Salhotra lauds the Modi government for moving in the right direction on railway reforms, but believes that the pace of change needs to pick up.

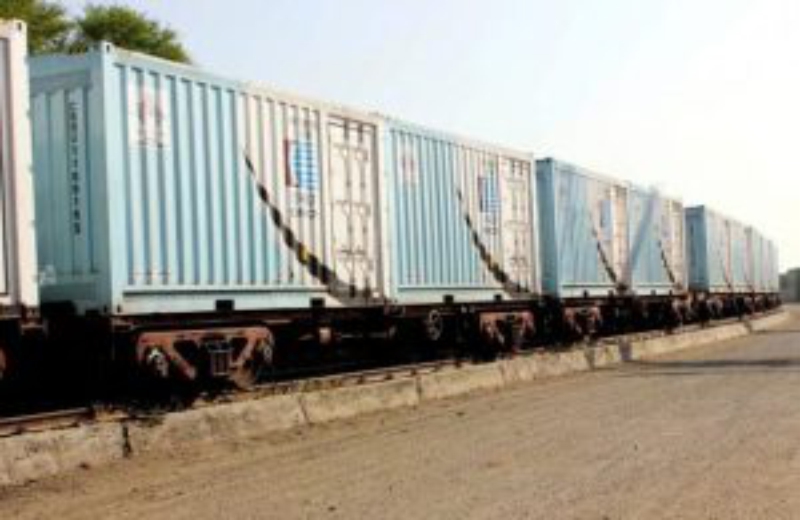

“The government has started with two freight corridors – Eastern and Western – but the plan is to build four more to complete the Golden Quadrilateral. A significant part of the rail traffic currently moves on the Golden Quadrilateral. Once that gets a DFC, it will transform the scenario not just for the Indian Railways, but also the business scenario in the country. The multiplier effect that we will see on the country’s GDP will be amazing,” he tells FE Online.

France giant Alstom is manufacturing 800 new 12,000 HP electric locomotives for Indian Railways at the Madhepura Locomotive Factory in Bihar. The new locomotives are aimed at helping Indian Railways double the existing speed of freight trains. The locomotives will run on DFCs and form part of the first major FDI project in the railways sector.

Salhotra is of the view that the average speed of freight trains on the network is determined by a number of things. “What is the priority of trains, horsepower, speed differential, inter-station distances etc. All those elements are being addressed by a combination of two things. One is the dedicated freight corridor – where the inter-station distances will range between 40 to 60 kms. This means that the locomotives and trains can gather a certain speed before they have to apply brakes.” “Also, by deploying the high horsepower locomotives on the dedicated freight corridor, we not only will increase the average speed of the freight trains, this strategy will also help the average speed on the passenger segment to go up,” he adds. Salhotra believes that with new locomotives and DFCs, the speed of freight trains on Indian Railways will be able to come up to global standards.

But even as he acknowledges that “green shoots” are visible in the growth story of Indian Railways, Salhotra stresses on the need to speed up the reform implementation process. “…so the direction is good, but the pace of change needs to pick up a little bit,” he says. “But again, let’s recognise the fact that the organisation has been steeped in performing in a certain way and therefore to dramatically and suddenly make a change could also be disastrous. I am beginning to see some very initial green shoots emerging. I am today far more confident of the Railways turning around, maybe not in the next one year, but over a period of time we will definitely see some improvement,” Salhotra adds, striking an optimistic note.

Asked what strategy he would suggest to Indian Railways to make money, Salhotra pitches for a market and customer oriented approach. “Railways is traditionally an old organisation that is inward looking, where the mantra to the customers is that ‘you buy what we sell’. That needs to be transformed into we will provide the right quality of service with reliability to the customers as they want it’,” he says.

According to the Alstom top executive, fright should form a very important focus area for the Indian Railways. “Railways has to move from bare bones destination-to-destination service to a door-to-door service. This would involve setting up multi-modal; terminals, Railways has to be involved like a logistics player rather than a a simple rail transport player,” he believes.

Comparing logistics cost with global levels, he says, “Today, logistics is a very important part of the cost that a company undertakes. For India, logistics accounts for almost 14% of the GDP. Whereas typically for the developed world it is in the vicinity of 4-6%. This means that India is spending far more on the movement of goods,” he rues. “Therefore in order for the businesses to be competitive, we have to reduce our logistics cost. Whether it is white goods or export of bulk commodities, the focus has to be on cutting down of the logistics cost,” he reiterates.

[/vc_column_text][/vc_column][/vc_row]