On 20 January, the Competition Commission of India (CCI) issued its final order in an alleged case of cartelization involving four Japanese shipping firms, asking them to desist from avoiding competition with each other. Mint takes a close look at the context and implications.

What is the case about?

When rivals in shipping industry form cartels, it poses a headache for regulators the world over, since price fixing among rivals is hard to prove. Hence, the law offers incentives for cartel members to turn whistle-blowers in return for leniency if they give full disclosure and cooperate with the probe. In 2014, Nippon Yusen Kabushiki Kaisha (NYK Line), one of the four firms involved in this case, reported the cartel to the commission and sought lower penalty, triggering a full investigation. The final order established the cartel’s existence, issued a ‘cease and desist’ order and offered lesser penalty in the case of three of them.

What constituted cartel in this case?

Here, the shipping firms were offering transportation service to vehicle makers from India to select overseas markets via certain routes, details of which were kept under wraps in the final order. CCI said there was an agreement among the shipping firms to avoid competition with one another, and that they had multilateral and bilateral contacts with one another to share commercially sensitive information including freight rates. In response to queries from Mint, NYK said it accepted the order, Mitsui O.S.K. Lines Ltd didn’t offer a comment, and Kawasaki Kisen Kaisha Ltd said it will weigh next course of action after final notice.

What is the penalty for cartelization?

The Competition Act calls for a penalty on each member of the cartel, which is up to three times its profit for each year of anti-competitive behaviour, or 10% of turnover for each year of its continuance, whichever is higher. However, in case of a leniency petition, CCI can waive penalty depending on the timing and usefulness of the disclosure and full cooperation in the probe.

What did the regulator order?

CCI ordered ₹38 crore penalty on NYK Line, but gave full waiver as it was the first to report the cartel. Kawasaki Kisen Kaisha was asked to pay over ₹24 crore without any waiver, Mitsui O.S.K. Lines was to pay over ₹24 crore but got a 50% penalty waiver, while Nissan Motor Car Carrier got a 30% waiver on its close to ₹41 crore penalty. NYK said in a statement to Mint that it was exempted from the payment of any penalties because of its complete cooperation with the probe, which was positively valued by CCI.

Why is the order significant?

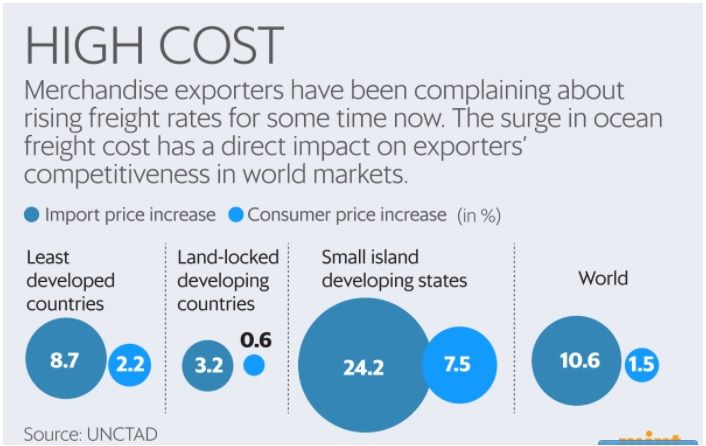

Merchandise exporters have been complaining about rising freight rates for some time now. The surge in ocean freight cost has a direct impact on exporters’ competitive-ness in world markets. The central bank said in a report that freight rates moderated across routes in December 2021, but they still remained above their pre-pandemic levels. In a sector that is known for cartelization, regulatory action for alleged anti-competitive behaviour and transparency in pricing would augur well for user industries like exporters.

Source: Mint