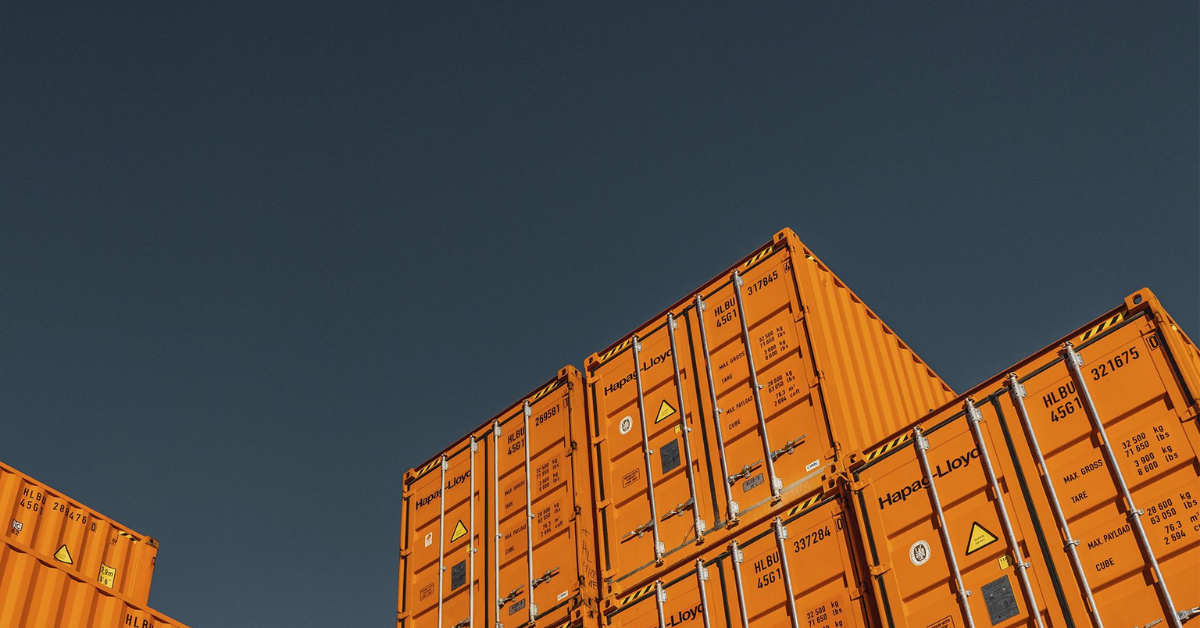

India’s ambition to emerge as a serious player in shipping container manufacturing has received a major policy boost, with the Union Budget 2026 earmarking ₹10,000 crore over five years to build a globally competitive container manufacturing ecosystem. The move is aimed at cutting dependence on imported boxes, reducing logistics vulnerabilities exposed during the pandemic, and aligning domestic capacity with the rapid growth in containerised cargo.

Finance Minister Nirmala Sitharaman told Parliament that container manufacturing has been identified as one of seven strategic and frontier sectors where India intends to scale up domestic capabilities. The proposed scheme will support the creation of manufacturing capacity while addressing the structural cost disadvantages that have so far kept India behind China in this segment.

Containers made in India are currently 30–40 per cent costlier than those manufactured in China, largely due to higher material costs and limited production facilities, said Hasmukh Viradiya, CMD of APPL Containers Ltd. By contrast, Chinese boxes are estimated to be about 700–800 dollars cheaper per unit, a gap that industry believes can be bridged if the budgetary support is directly used to neutralise this cost differential. Viradiya suggested that the Union government should channel the scheme funds as a per-container manufacturing subsidy rather than for setting up new units or offering interest subsidies, which some states already provide.

The container manufacturing assistance scheme is designed to target an annual domestic capacity of about 1 million twenty-foot equivalent units over a ten-year horizon, a government official said. This scale-up is expected to support the high growth rate of containerised cargo, which accounts for nearly two-thirds of the value of international trade.

According to initial estimates, the scheme could generate a market value of around ₹80,000 crore over its life, implying a leverage of roughly eight times the budgeted outlay. It is projected to create direct employment for about 3,000 people and indirect jobs for nearly 50,000 others, including handlers, trailer operators and truckers in the wider logistics ecosystem.

Global and domestic maritime players are already seen as potential entrants into the container manufacturing space on the back of this policy support. Companies such as Mediterranean Shipping Company (MSC), Maersk, Tata Group’s Artsons, Adani and J M Baxi may explore investments in the sector as the scheme gains shape, the official indicated.

A key objective of the initiative is to cut India’s reliance on imported empty containers, which currently stands at up to 2 million TEUs a year for export stuffing. The planned Bharat Container Line alone is expected to require around 1 million TEUs for its operations, underlining the scale of domestic demand that could be met by local manufacturing. The scheme, the official said, will reduce India’s dependence on imported containers, strengthen national logistics capability and enhance overall supply chain resilience.