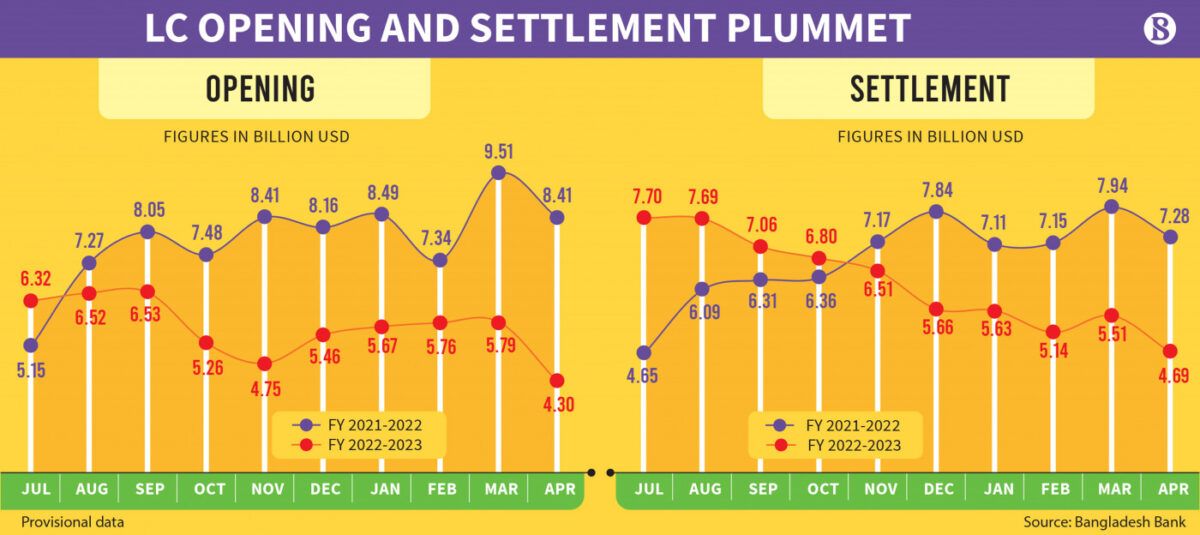

Opening of import Letter of Credit has reached a 32-month low in April 2023, due to a combination of restrictions implemented by the Central Bank and the ongoing dollar crisis. Additionally, LC settlement reached a 21-month low, mainly due to a significant decline in LC openings witnessed in recent months. According to the Bangladesh Bank, import LCs worth only $4.30 billion were opened last April, which is a 49% decrease compared to the same period a year ago.

Earlier, in August 2020, a lower amount of import letters of credit were opened, amounting to $3.70 billion. This occurred during a period when the country’s economy was at a standstill due to the impact of the Covid-19 pandemic.

Furthermore, in April, import LC settlement amounted to $4.69 billion. However, in July 2021, a lower payment was made, with LC payments totaling $4.65 billion for that month.

Emranul Huq, managing director & CEO of Dhaka Bank, told The Business Standard, “The shorter working days of the banks in April, due to Eid-ul-Fitr, contributed to the lower number of LC openings last month. Additionally, the current shortage of dollars in the banking channels has made banks more cautious in opening LCs.”

He added, “Our export income is on the decline. Besides, despite April being the month of Eid, remittances have come in less than the same period of the previous year. As a result, there are now no dollars in the bank channel to open import LCs on demand.

Several importers, who prefer to remain anonymous, have expressed that despite fulfilling all the conditions set by the central bank, banks are not opening import LCs in accordance with the demand.

During the period of July to April in the current financial year, a total of $56.36 billion worth of import letters of credit were opened, marking a decline of approximately 27% compared to the same period in the previous financial year. Additionally, LC settlements in the first 10 months of the fiscal year amounted to $62.40 billion, reflecting a nearly 8% year-on-year decrease.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said the low opening of import letters of credit has wide-ranging implications for various aspects of the economy.

“The low import of capital machinery and industrial raw materials has a direct impact on the manufacturing sector of the country. When manufacturing companies are unable to operate at their full capacity, it leads to ripple effects on other sectors, including transportation and marketing at the consumer level,” he said.

Furthermore, Zahid Hussain emphasises that the decline in import duty, taxes, and value-added tax (VAT) negatively impacts government revenue. It also hampers investment opportunities, leading to a potential cycle of inflation resulting from reduced goods supply.

He points out that this inflation is not imported from external sources but rather created domestically, indicating the need to address the internal factors contributing to the economic challenges.

According to the central bank, there has been a significant decline in the opening of LCs for capital machinery, specifically in sectors such as textile and leather machinery, with a decrease of 57% in April compared to the same period last year.

Additionally, machinery for industries like computers or motorcycles has seen a decline of 46%. The data also reveals a decrease in LCs for industrial raw materials, including textile fabrics and chemicals, by 32%. Intermediate goods such as cement and scrap vessels have experienced a decline of 31%, while consumer goods like rice and wheat have seen a decrease of 18%.

Zahid Hussain said that it is important for the central bank to acknowledge the limitations of the measures implemented to address the dollar crisis, such as increasing the LC margin and introducing multiple exchange rates.

“These decisions have resulted in a decline in remittances and export proceeds. It is particularly concerning that the exchange rate of the dollar is not allowed to be determined by the market, as this could potentially exacerbate the crisis even further,” he added.