Certification renewal not required for AEO-T1 entities

The Central Board of Indirect Taxes and Customs (CBIC) on Saturday said it has done away with renewal of Authorised Economic Operator certification for AEO-T1

The Central Board of Indirect Taxes and Customs (CBIC) on Saturday said it has done away with renewal of Authorised Economic Operator certification for AEO-T1

To cut short the time for customs clearance and to effectively check smuggling, the Central Board of Indirect Taxes and Customs (CBIC) is exploring deals

The Central Board of Indirect Taxes and Customs (CBIC) has abolished the requirement of periodic renewals of Licence/Registration issued to Customs Brokers and Authorised Carriers

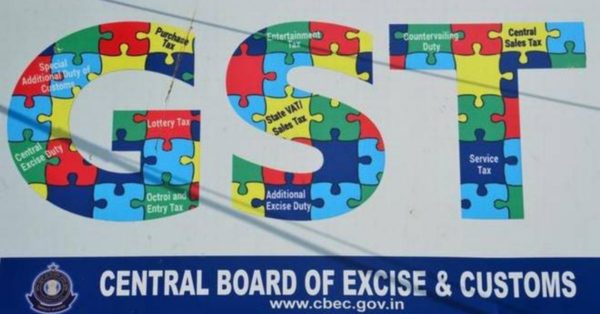

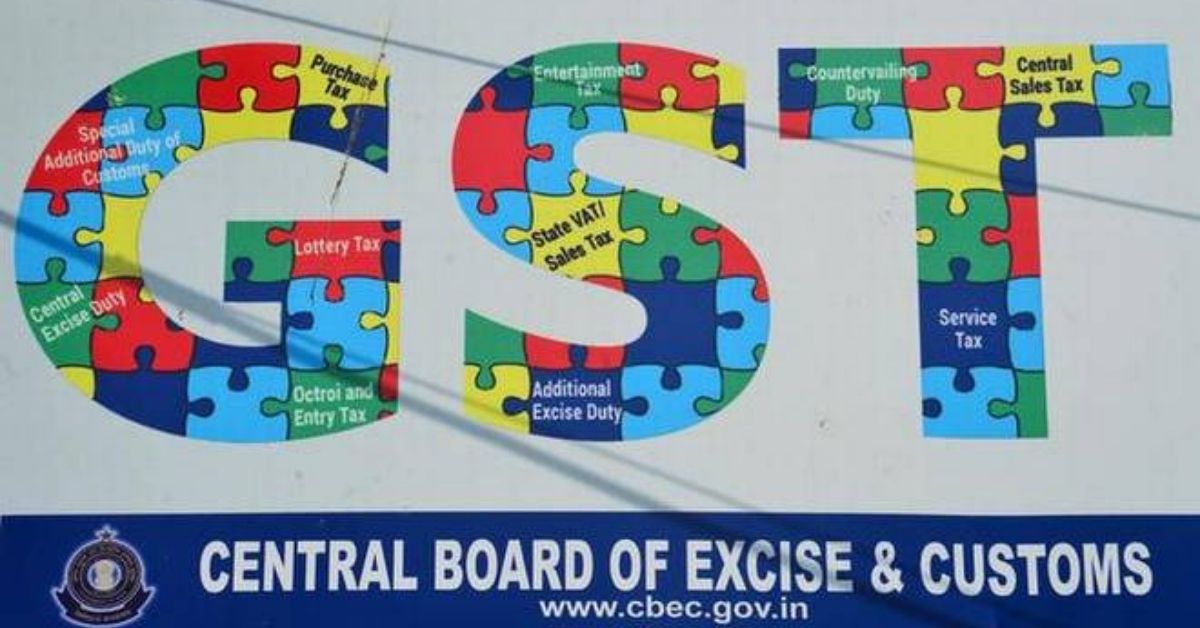

As we all know, a refund is a very significant term under the GST for the person who is eligible to claim the refund and

The Centre continues to tighten the noose around GST evaders, though its crackdown on fake invoices slowed down in recent months due to the COVID-19

The government has identified a host of customs exemptions for review and has invited suggestions from trade and industry bodies on the same. Importers, exporters, domestic

The Central Board of Indirect Taxes and Customs (CBIC) has unveiled the upgraded version of online filing of Authorised Economic Operators (AEO) T2 and T3

The Central Board of Indirect Taxes and Customs (CBIC) issued the measures for expediting Customs clearances so as to improve in Faceless Assessment. The CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has notified extension of tax relief given on imported medical supplies used in prevention and treatment

The Central Board of Indirect Taxes and Customs (CBIC) on

The Central Board of Indirect Taxes and Customs (CBIC) has

The Centre continues to tighten the noose around GST evaders,

The government has identified a host of customs exemptions for

The Central Board of Indirect Taxes and Customs (CBIC) has

The Central Board of Indirect Taxes and Customs (CBIC) issued

The Central Board of Indirect Taxes and Customs (CBIC) has