All the major ports in India are serving the compliant fuel, supplied by state owned oil companies. Dr Abhijit Singh, Executive Director, IPA explains the fuel dynamics

Which of the seaports in India are offering bunkering service and which of them are supplying low sulphur fuel?

The premier state owned Oil Companies M/s IOCL, HPCL and BPCL or their authorized agencies have been allowed to offer bunkering activities at the major ports. Bunkers in Major Ports are supplied to ships mostly through a bunker barge or fuel supplying vessels. Bunkering has been permitted round the clock at the Paradip Port and Cochin Port. At Paradip, pipeline is laid from IOCL Terminal to North Oil Jetty which is approximately 10.5 kms and vessels / barges can be loaded with bunker fuel (VLSFO) directly through pipeline. Cochin Port offers bunkering through pipeline at berth and also through barges. As of January 2020, IOCL has confirmed that among 8 ports covered by them there is already sufficient stock. BPCL has stock in Mumbai and HPCL has stock at Vizag with barges equipped to make supply within ports. IOCL also offers bunkering at Kamarajar Port from there foreshore terminal facility at Chennai Port Trust through barges and trucks. In order to boost the bunkering trade at the ports dedicated bunkering facility is being planned at Paradip, DPT and Cochin. At VPT currently bunkering takes place through 3 modes, bunkering through pipelines, through barges at New Bunker jetty and truck bunkering is done by loading Tank Trucks at black oil terminal and later trucks pumping the bunker fuel to vessel at respective berth.

All the Major ports have started offering low sulphur fuel to vessels/barges as per the new IMO 2020 regulations.

What is the volume of demand expected at each port for low sulphur fuel?

Bunker Fuels demand at Indian ports is about 1per cent of the global demand. Majority of the demand comes from defence ships, domestic vessels, coastal vessels and a small portion of international ships calling at Indian ports. On an average, 27,000 ships call at Indian ports and this number is expected to grow by 7 per cent.

As per the statistics from Ministry of Petroleum and Natural Gas (MoPNG), 1.38 MTPA of HFO, HSD and LDO deliveries were made; 0.42 MTPA to international bunkers and 0.96 MTPA to coastal bunkers. Indian bunker segment is majorly distributed between defence, trading, direct sales and exploration & dredging. IOCL is the largest bunker provider with 41.6 per cent market share with Adani, HPCL and BPCL contributing to 18 per cent, 15 per cent and 10 per cent share respectively

As per the available data for few Major ports, the demand scenario for low sulphur oil is as follows:

- Cochin Port handled total of 45301 MT of low sulphur fuel in the month of January and February 2020. The future demand is expected to remain around 25000 MT/month.

- For Paradip Port, the current demand is around 2000 MT/month and is expected to reach 4000 MT/month.

- Deendayal Port Trust, Kandla handled total of 52889.11 MT of low sulphur fuel in January and February 2020. Demand is expected to remain at 300,000 MT for the year

- Murmugao Port handled total of 15,550 KL of low sulphur fuel last year and the demand is expected to remain almost same.

- At Visakhapatnam Port Trust the volume of demand expected is 166,400 MT per annum

What is the volume of stock of low sulphur fuel available at each of these ports?

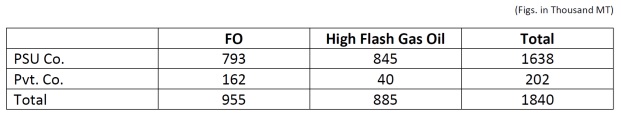

During 2018-19, sales of marine bunker fuels in India (FO & Marine Gas Oil) is 1840 million MT. The consumption remains at the same level of 2017-18 (1842 million MT). Following summarizes the sale of bunker fuel in India during 2018-19 (Source: HPCL Presentation).

Outlook projects increase in bunker consumption from 955 thousand MT (FO) to 1060 TMT by 2024-25. VLSFO consumption will start from last quarter of 2019-20 and will pick up by 2024-25. HSFO will not only be replaced by VLSFO gradually but some vessels are expected to shift to marine gas oil in 2019-20. Consumption of MGO will increase to 65 in 2020-21 but will start reducing thereafter to reach a level of 20 TMT by 2024-25. HSFO will show sharp decline by 2020-21 to 70 TMT but is expected to increase (after installation of scrubbers pick up the pace) to 195 TMT by 2024-25.

IOCL is supplying VLSFO in Indian markets from September 2019, ahead of MARPOL 2020 time line. Its Gujarat Refinery will produce MARPOL compliant 1.0 million MT per annum VLSFO from LS residues. VLSFO will be meeting ISO 8217:2017 RMG 380 with viscosity between 220-300 CST. And sulfur 0.5 % m/m. This will be made available at all port locations having bunkering facilities in India through coastal movement from Kandla where it will reach through rail route.

The stock availability for low sulphur oil at few major ports is as follows:

- Deendayal Port Trust, Kandla has stock of 36,498 KL available at the port

- Mormugao Port has 3550 KL of stock available at port

- Volume of stock of low sulphur fuel available at Paradip Port is 19000 MTs

- Visakhapatnam Port Trust has stock of 24,800 KL and VLSFO – 43000 MT